Initial DEX Offering: The Challenges, Benefits, and Future of IDO

Initial DEX Offering (IDO) is an effective way to raise funding for your decentralized crypto projects. Investors can quickly invest in crypto projects with promising futures and get project tokens in return. An interesting possibility for traders in the crypto ecosystem is typically a token issuance. The opportunity to purchase a token at release can be very lucrative.

However, this only tells a portion of the tale. Going back, there weren’t all good things about the ICO (Initial Coin Offering) mania that hit Ethereum in 2017. People typically experienced significant losses as a result of fraud and rug-pulling.

The initial DEX offering (IDO) was established as a substitute by the cryptocurrency community at that time. IDOs have grown to be a suitable method, but how do they vary from ICOs, and are they secure to utilize for crypto investors? What is the future of IDO along with its risks and benefits?

We will explore the answers to all these questions in this blog. But, first, we will explain the concept of token offering and the Initial DEX Offering (IDO) in detail. Let’s get going!!

The Fundamental Concept of Token Offering

In a token offering, an initiative or firm sells a brand-new virtual currency to raise money. There are various ways to raise money through crowdsourcing, including collaborating with a regional regulatory authority (STO), managing the procedure through a centralized cryptocurrency exchange system (IEO), or just continuing it alone (ICO).

While some buyers buy the tokens for use, others acquire them for investment purposes. The token could be used, for instance, for yield farming, staking in a governing structure, or covering trading costs.

How Does an IDO Function?

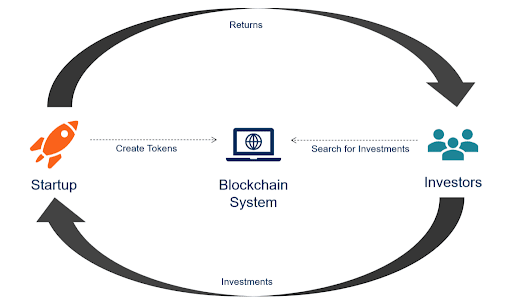

A decentralized exchange (DEX) is used by an IDO to make the token sale possible. The DEX receives assets from a cryptocurrency project, individuals contribute resources to the forum, and the DEX fulfills the release and exchange of all monies. Through the use of blockchain smart contracts, these procedures are done automatically.

The procedures and stages of an IDO vary depending on the DEX managing it, although some are standard:

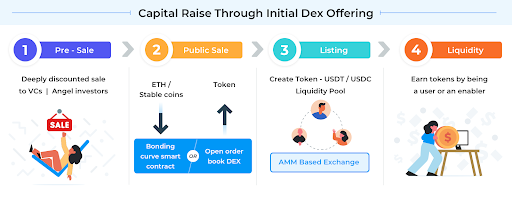

Crypto project is granted permission to execute an IDO on a DEX after being put through a verification procedure. Participants deposit their money in exchange for a specific number of coins they are offering at a specified rate. The coins will be distributed to crypto investors during a subsequent token generation event (TGE).

A whitelist of investors is typically present. To get on the list, you could simply need to enter your digital wallet address or perform promotional strategies.

A portion of the revenue collected is utilized to combine the initiative’s coin with a liquidity pool. The team receives the remaining sum of money. After the Token generation event (TGE), users can exchange the asset.

The offered equity is often restricted for a particular amount of time. The Liquidity Pool opens for exchange at the TGE, and the coins are distributed to the participants.

What are the Benefits of IDO?

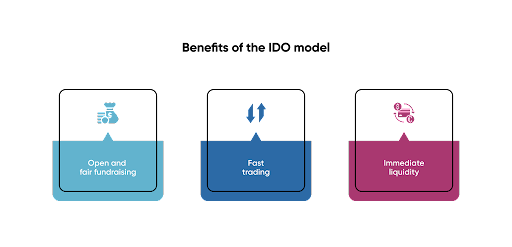

The benefits of IDO for crypto initiatives are overwhelming. For participants, token offerings have largely improved over time in terms of fairness and security.

IDOs offer several noteworthy benefits that bolster this:

You don’t have to work with a venture personally or believe in its smart contracts. A trustworthy IDO platform has several closed sales. You should have some confidence in the offerings if the agreements are identical.

Post-sale liquidity is offered right away. To establish a stable market after the offering, IDOs will place a portion of the money generated in liquidity pools. This lessens fluctuations and irregularities.

No registration is necessary. Private information is not necessary to take part in the event; all you need is a wallet and money. This makes it accessible to all participants. Nevertheless, the absence of KYC or AML procedures might also be seen negatively.

IDOs are available and reasonably priced for initiatives. A smaller, lesser-known startup may frequently find it simpler and less expensive to sell their tokens by a DEX than through a major, centralized exchange.

Anti-whale actions are frequently used by IDOs, preventing any one buyer from purchasing a sizable quantity of assets.

These were some of the benefits of IDO, let’s move to see what the challenges of IDO are:

What are the Challenges of IDO?

The benefits of IDO contribute to some of its drawbacks. The challenges of IDO are mostly caused by its decentralized and secretive nature.

No AML or KYC can be problematic for some individuals. When the necessary checks are carried out, individuals and enterprises are safeguarded. These precautions aid in preventing the washing of illicit money and the circumvention of financial restrictions. For instance, if the token qualifies as a security, some jurisdictions might not be permitted to legally engage in an IDO.

The distribution of a token by a dubious enterprise is considerably simpler through an IDO than it is through an IEO with a sizable, regulated market.

Let’s move further to see how you can avoid scams in IDO.

How to Avoid Scams in IDO?

Scams in IDO are creating major problems for the ecosystem. We have covered the challenges of IDO, but crypto is a speculative and hostile place for crypto investors. Let’s see some tips to avoid scams in the IDO ecosystem.

IDO Website Link

To join the IDO, click on the appropriate link. Hackers may set up bogus registration webpages and get the most out of the enthusiasm and buzz surrounding an IDO. Any cryptocurrency that you send to a fraudulent site will be gone forever.

Utilize a reliable DEX Platform

You can indeed engage in IDOs on many reliable DEXs, such as PancakeSwap and BakerySwap. Using such a platform increases your chances of getting your coins from the sale smoothly.

Proper research

Is it a staff you presently trust implicitly? The acquired money will be reinvested? Exists an item that can already be used? You can estimate the probability of a potential rug pull by asking more questions.

Policies and Guidelines

Please review the IDO policies and guidelines. Your coins might not arrive right away, or they might even be pledged and stored for a while. The initiative’s tokenomics will determine almost everything, thus you should fully comprehend them.

Risk Management

Only make investments you can risk losing. The impression of token sales as being extremely volatile exists. It’s simple to get overexcited and invest more cash than is prudent. But keep in mind that sales are still dangerous, even with a thorough investigation, you can still fall for a hoax, Ponzi scheme, or rug pull.

These were some ways that crypto investors can utilize to avoid scams in IDO.

What’s the Future of IDO?

Although the aforementioned approach is a standard IDO, token offerings are always evolving. We also have the growingly well-liked IFO (Initial Farm Offering) concept, for instance. Although it’s difficult to determine whether it qualifies as a typical IDO, it is based on the exact fundamental ideas as one: liquidity pools and decentralized exchanges.

Crypto Investors should first engage in a Decentralized Finance (DeFi) Liquidity Pool to gain LP coins instead of locking their assets immediately. For instance, buyers will need to deposit BNB and CAKE in the BNB-CAKE LP for a venture that wants to sell its currency for Binance coin in an Initial Farm Offering on PancakeSwap.

The crypto project will receive the BNB through the BNB-CAKE Liquidity pool. The number of BNB coins depends on the number of users in the project ecosystem. The crypto initiatives also get the assets that come after the completion of the staking requirement.

The implementation of KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols could be another adjustment to IDOs in the future. International economy authorities are becoming more interested in DeFi and its legislative standing. AML and KYC are now requirements for trading platforms, and DEXs might someday follow the same guidelines.

You should also note that the future of IDO is secure, reliable, and effective for fundraising of crypto projects.

Hire HashVerse For Your IDO

HashVerse’s IDO (Initial DEX Offering) solutions have completely transformed the fundraising game for blockchain projects. It’s like a breath of fresh air in the crypto world. With us, you can now raise funds and connect with communities in a whole new way. It’s all about embracing the power of decentralized finance and blockchain technology to create a secure and transparent platform.

What’s really cool about our IDO solutions is that we’ve taken fairness and inclusivity to heart. We’ve thrown out the old playbook and implemented a decentralized allocation mechanism. No more shady dealings or behind-the-scenes manipulation. Instead, we use smart contracts to make sure everyone has a fair shot at participating in the token sale. It’s all about giving power back to the people, and that’s something I can definitely get behind. Get in touch with us for your IDO launch.

Bottom Line

IDOs have developed into a typical funding mechanism for several new initiatives in the cryptocurrency industry thanks to their combination of usability, cost, and openness. In fact, the market of token offerings has grown independently. In conclusion, it is generally safer to participate in a sale with a Decentralized Liquidity Exchange rather than an enterprise.

However, choosing the correct initiative is crucial to an IDO’s performance. Nothing trumps traditional analysis in the cryptocurrency realm for this.

Featured Blogs

Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo con

" alt="">

" alt="">

" alt="">

" alt="">

" alt="">

" alt="">